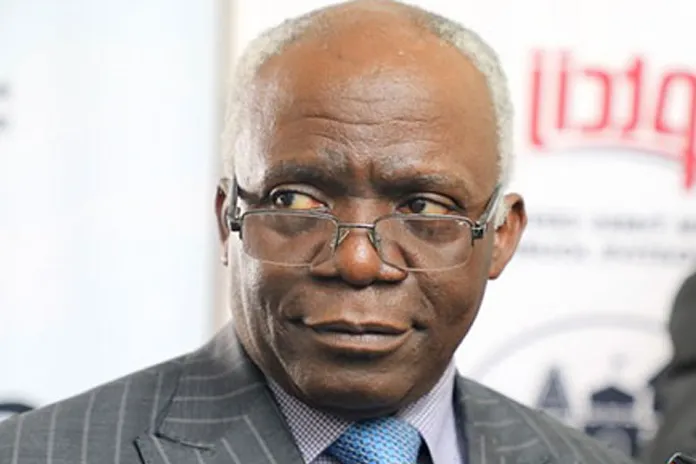

Femi Falana, a human rights attorney and Senior Advocate of Nigeria, upbraided the International Monetary Fund (IMF) and World Bank for orchestrating Nigeria’s full removal of fuel subsidization.

In a recent televised interview, Falana asserted that no country in the world has removed all obligations of subsidy. He elaborated that developed countries, including the western economies – continue to subsidize various sectors such as electricity, agriculture, and social services. He argued that there is no reason to believe that Nigeria should pursue a policy that eliminates its citizens’ base of support.

“The IMF and World Bank are behind this policy – they told Nigeria to remove subsidy altogether, but no country has removed it all.” Falana said.

However, the IMF has refuted any such assertion. In statements, they reaffirmed that subsidy removal was an entirely sovereign decision made by the Nigerian government. They contended that their role is strictly limited to acting as policy advisers, not imposing national reforms.

At this time, there is no apparent public evidence that Abuja entered into any agreement with the IMF or World Bank imposing the removal of the subsidy. The Tinubu administration insists that the elimination of the subsidy entirely was required to reallocate national resources to key domestic spending in infrastructure and social spending.

Meanwhile, critics assert the removal of the subsidy, particularly with no effective palliatives provided, is exacerbating hardship, as rising fuel costs rapidly increases transport fares, food prices and costs of living overall.

Falana’s commentary appears amid rising discussions about whether the government will be able to untangle its recently implemented fiscal reforms while also addressing social justice. On one hand, government officials emphasize the long-term benefits of removing subsidy; although many Nigerians in the interim continue to face the pain of inflation and reductions in purchasing power.

As the debate continues, questions about the role of international financial institutions in shaping domestic policy persist.

Read more Nigeria news today at the homepage.